Post Series: Selling to the Enterprise

The enterprise SaaS industry is booming. Much has been written about how to scale B2C tech, as consumer technology companies such as Google, Facebook, or Netflix enjoy near-monopolies, employ hordes of people, and command appropriately dominant mindshare. A relative lack of material has been written about building enterprise software, particularly from a product & engineering point of view.

In this post series we’ll describe techniques on building an easily sellable SaaS product. To set the stage, we’ll define “enterprise buyers” as companies that:

Employ 500+ people

Are prepared to pay around $100,000 or (much) more for strategic products

Regularly make long-term, multi-year software buying commitments

Enterprise Sales is Like Marriage

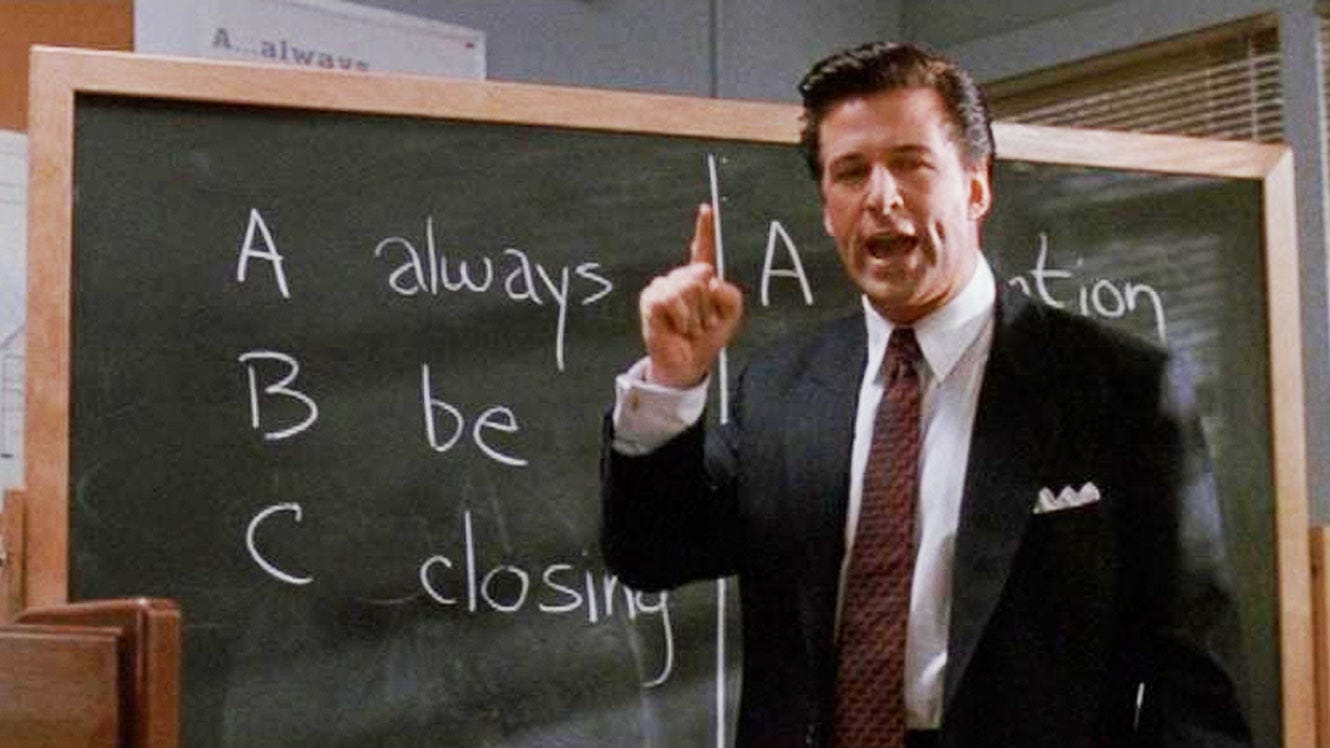

SaaS covers a wide spectrum of businesses: from enterprise products that cost tens of millions of dollars over multiple years, to freemium products that start at $10/month. The strategies that help you sell one will not (typically) work for the other. The process of settling on the former product is like getting married: months to years building the relationship, multiple suitors, and meetings with the parents, all with the intention of making a decades long commitment. Buying a $150/year utility SaaS, by comparison, is like a Tinder date that ends with getting busy in the back of a Prius.

Once you see the similarities between enterprise buying and marriage, many dimensions of how to sell high-value SaaS become more clear:

Like a marriage, it’s important to have integrity. Don’t oversell – put your best foot forward (brush your teeth before the first date!) but have integrity in how you sell yourself (don’t lie about your job, your height, or where you went to school).

You need to offer something differentiated. Nobody wants to settle – you need to be the best catch in at least one, and preferably multiple important dimensions.

There are a lot of stakeholders. “Meeting the parents” is a key step in serious dating; meeting your buyer’s Procurement and Infosec teams can be a (disturbingly) similar experience.

You need to be the right partners for each other. Enterprise sales relies upon product/customer fit – you should solve a need for your buyer, and you should be able to actually deliver. A common example: over-selling to a Fortune 500 company as a 40-person company, when you don’t have the stability, maturity, or headcount to deliver the service that they expect. Maybe you all are just meeting at the wrong moment in your lives.

When I began my career I didn’t understand this dynamic at all. I imagined that enterprise sales was like trying to meet someone at a bar: look as hot as possible, go to a few steak dinners, dance poorly and hope for the best. Superficial stuff. In reality, building a product that can sell to big-company buyers requires scoring well across a broad constellation of factors: the equivalents of getting a good education, having a steady job, and demonstrating that you know how to clean your apartment. Enterprise buyers expect to be courted, and as a builder you have the tools to put your best foot forward.

The Anatomy of an Enterprise Sale

These posts on how to sell to the enterprise are rooted in the core drivers that impact huge software purchases. Understanding these drivers as a product builder can help you navigate the arcane “dating” process behind closing your first (or next) enterprise logo:

Spending millions of dollars on a software solution is necessarily a complex process due to the sheer amount of “stuff” going on at a large company.

Enterprise software deployments have a complex web of stakeholders. The buyer of enterprise software is often different from the user, as software is (often) bought by executives but used by their teams. Decisions on which vendors to use can take on a political dimension, as they can make or break careers.

Change is extremely expensive to enterprise buyers because they’re massive and built for momentum over agility. Like a battleship, they can carry a lot of people very far but are a pain to turn. Enterprise companies value stability, and they want to commit upfront to a long-term partner.

In this series, we’ll discuss strategies for building a product that will sell to the enterprise, and that will keep them happy for years. Following posts will break down strategies we’ve found helpful, and hopefully provide some ideas as you develop your own products.

Takeaways

Building a product that can sell to the enterprise is difficult but rewarding.

Enterprise sales is like dating with intent to marry, with many of the same dynamics.

Enterprise buyers’ decision-making is influenced by several important drivers: the complexity of enterprise businesses, complicated webs of stakeholders, and the need to plan on long time horizons.